Along with Urasia, there is another junior uranium company who has managed to take a shortcut into inevitable U308 production. Although their stories diverge somewhat, it is somehow fitting that amongst uranium enthusiasts such as myself who value present production, one is often mentioned with the other. This company is Australia's Paladin Resources.

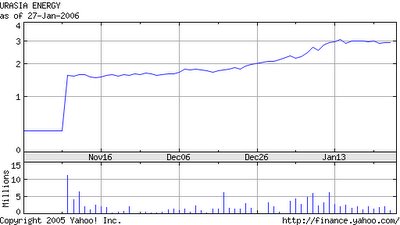

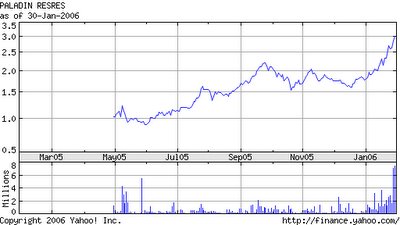

As evidenced by the chart, Paladin has almost tripled since the 2nd quarter of 2005. An impressive return, and one that, when examining significant milestones for the company, would lead to the conclusion that the risk involved in buying this company is not as great as it seems.

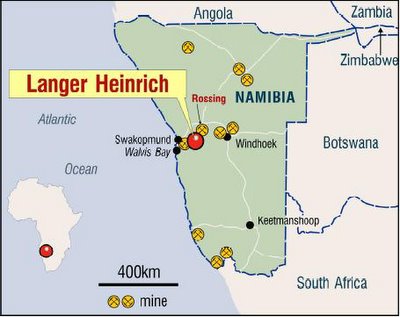

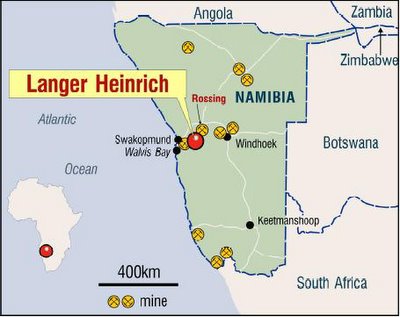

Paladin is from Perth, Australia, and was mentioned in my last post about the importance of that country's impact on the uranium landscape. Having been stymied for years by their own government, Paladin decided to branch out into the more exotic parts of the world: Namibia and Malawi. Their project in Namibia is known as Langer Heinrich and the one in Malawi as Kayelekera.

Namibia's Langer Heinrich: A Little History

In August 2002, Paladin acquired 100% of Langer Heinrich Uranium (Pty) Ltd., the Namibian company holding the Project rights and completed a Pre-Feasibility study at a cost of US$ 1.26 million. This study was followed by a US$ 3.0 million Bankable Feasibility Study (BFS) that was completed in April of 2005. After full management review of the BFS, the Board resolved on May 9, 2005 to proceed with development of the project.

In August 2002, Paladin acquired 100% of Langer Heinrich Uranium (Pty) Ltd., the Namibian company holding the Project rights and completed a Pre-Feasibility study at a cost of US$ 1.26 million. This study was followed by a US$ 3.0 million Bankable Feasibility Study (BFS) that was completed in April of 2005. After full management review of the BFS, the Board resolved on May 9, 2005 to proceed with development of the project.

May 9, 2005 Press Release (Paladin Close $1.22Cdn)

Preamble: When I re-read all of Paladin's press releases, the one that's most interesting to me by far is this one, the day they gave the go ahead for development of Langer Heinrich.

The BFS document covers all aspects of the Project including resources/reserves detailing, mining, production, tailings disposal and uranium marketing. The BFS is supported by comprehensive environmental studies and management plans. The Project is designed to produce 1,180 tonnes (2.6M lbs) per annum (tpa) of uranium oxide concentrates (U3O8) from 1.5 M tpa of calcrete associated ores by ore beneficiation, alkaline leaching (heating to 750C), counter-current decantation, ion exchange, precipitation and calcining to produce saleable U3O8.

Using the ore reserve base of 22.24Mt at an average grade of 0.071% U3O8 the BFS has a scheduled mine life of 11 years and a process plant life of 15 years. Based on the mill throughput design of 1.5Mtpa of ore, the BFS shows 1,180tpa U3O8 can be produced for the first 11 years at a head feed grade of 0.0875% U3O8 and 401tpa U3O8 over the last 4 years, using the accumulated low grade stockpile grading 0.032% U3O8. The operating costs for the reserve defined BFS averages US$14.18/lb U3O8 over the life of the project and for the first six years costs average US$12.20/lb U3O8. The capital costs total US$92M including a 10% contingency plus an "accuracy provision" totalling US$10M. The capital costs have increased from that which were previously stated.

The BFS clearly indicates that the Langer Heinrich Uranium Project can be developed into a profitable mining operation. The BFS incorporates a uranium pricing schedule for U3O8 ranging from US$26/lb to US$35/lb over the 15 year period. The BFS financial modelling shows highly attractive returns can be achieved based on using defined reserves only. Paladin is currently unable to release the economic analysis resulting from the BFS work, which incorporates 50% of the Inferred Resources, due to restrictions under Canadian securities laws respecting disclosure of results of economic evaluation which uses Inferred Resources. Paladin intends to apply for an exemption order from such restrictions from the Ontario Securities Commission so as to be able to release this information.

Nevertheless, even on the reserve constrained BFS model and the conservative pricing schedule, the Project is able to pay back initial capital and working capital 3.5 years after commencement of operations (scheduled for start up for September 2006) showing the robust nature for the Project.

Analysis: there are several things to like about the last couple of paragraphs. First of all, rough mathwork would tend to agree with their calculations. Let's assume that within the next 3.5 years their projection of uranium oxide price was $27/lb (first three years of a 15 year price projection would be closer to $26 than $35 of course). So, 3.5 years 2.6 million lbs/yr * ($27/lb - $12.2/lb for operating costs) = $134 million. Enough to pay the capital cost of $92 million + 10% contingency. However, there is one happy flaw. Uranium is at $37/lb already. $113 million becomes $225 million. Paladin's transparency with their rojections and the direct way in which investors like I can pick up on what, when and how to best achieve their goals are is one that lends confidence.

All documentation for the Langer Heinrich Mining Licence Application, including the BFS, Environmental Assessment Study and Management Plan, has been prepared and presented to the Ministry of Mines and Energy in Namibia for review and approval. The application has been made for the maximum of 25 years. Initial responses have been favourable and approvals to allow the Project to proceed to development and mining are expected by the end of the 2nd quarter 2005.

Analysis: Excuse me? Did they say 2nd quarter? Indeed, remember this press release is dated May 9th! Apparently, there is a HUGE difference between obtaining uranium development and mining permits in Namibia than in Canada, let alone Australia. This was exactly the reason why Paladin came here.

September 16, 2005 Press Release (Paladin Close $1.97Cdn)

Paladin announces that the Namibian Minister of Mines and Energy, The Honorable Mr E Nghimtina at a ceremony held at site yesterday, September 15th, officially initiated the commencement of construction activities for the Langer Heinrich Uranium Project. The ceremony was attended by a number of Namibian Government officials, local community representatives, as well as Namibian media. In welcoming the Minister, Paladin Resources’ Chairman, Rick Crabb, noted that Langer Heinrich will be Namibia’s second uranium mine and will make Namibia the 4th largest uranium producing country in the world.

Analysis: May 9 to September 16. Shade over four months. Crazy.

November 9, 2005 Press Release (Paladin Close $2.03Cdn)

Paladin Resources Ltd (Paladin) is pleased to advise that drilling of the previously untested palaeochannel, extending west from the Detail 1 orebody, has returned very encouraging results. Compared to the previously reported Mineral Resources (estimated with the 300ppm cut off) the new resource estimates at 250ppm cut off represents an increase in contained U3O8 as follows:

· A 24% increase in the Measured and Indicated Resources (from 17,100t to 20,200t U3O8).

· A 52% increase in the Inferred Resources (from 15,700t to 23,800t contained U 3O8).

Analysis: That's quite an increase in reserves, although I do not think they are planning to pump more uranium oxide out each year. Rather this will probably lengthen the mine life.

December 21, 2005: Paladin Resources Ltd (Paladin Close $1.70Cdn)

Paladin has secured the services of Mr. Wyatt Buck, a top uranium operative who will assume the position of General Manager of Langer Heinrich mining operations based in Swakopmund, Namibia. Mr. Buck qualified as a Mechanical Engineer at the University of Saskatchewan in 1981 and was later a senior executive for 15 years with the Cameco Corporation, a Canadian company that leads in uranium production. For the past 2 years he held the position of General Manager of the McArthur River Mine and the Key Lake Mill, the highest producing uranium operation in the world.

Analysis: Quite an impressive resume, good move by Paladin to bring in a uranium specialist with this much experience. Another confidence builder.

January 19, 2006: Paladin Resources Ltd (Paladin Close $2.34Cdn)

Paladin has secured its first sales contract for a portion of its yellowcake (U3O8) production from the Langer Heinrich Uranium Mining Operation, scheduled for commissioning in September 2006. This sales arrangement with a major US utility is subject to finalisation of all necessary legal documentation. The sales contract is for the purchase of 2,145,000lbs U3O8 for delivery between 2007 and 2012. Pricing will be market related to be determined at time of each delivery with escalating floor and ceiling price components.

Analysis: Speed and efficiency seems to be the modus operandi for this company. Impressive how they haven't even began production an already has secured a contract that is NOT hedged, but will take advantage of the uranium price increases.

January 19, 2006: Paladin Resources Ltd (Paladin Close $2.34Cdn)

Paladin is pleased to advise that infill drilling of the Kayelekera Deposit, has returned very encouraging results. This work has produced a twofold benefit:

· Firstly, the results have added significantly to the presently stated Mineral Resource estimates for Kayelekera; and

· Secondly, have allowed most of these resources to be classified into the Measured and Indicated Resource Categories with a small percentage retained as Inferred Resources. As can be compared from the above, the resources for Kayelekera have been increased substantially. At the 300ppm cut -off limit, Measured and Indicated Mineral Resources identified amount to 15.31Mt grading 0.09% U3O8 and 3.4Mt of Inferred Resources at 0.06% U3O8 versus the previously stated 9.4Mt grading 0.12% U3O8. The resource estimates for both the 300ppm and 600ppm U3O8 cut-offs are provided herein because at this stage the economic cut -off that will be applied from the mine modelling work is unknown but is expected to be between these two cut -off limits. These results do show, however, that a 10 year mine life producing approximately 1,000t U3O8 per year is likely as a minimum and that the possibility exists to extend this mine life and/or annual production depending on the final economics that are determined from the BFS. The increase in tonnage and decrease in grade from the previously stated resources is due to the fact that the high grade core of the deposit was well defined by previous drilling and the new drilling focussed mostly on defining the peripheral zones of the deposit. Consequently, this work added mainly lower grade material to the resource estimations. In total, however, the new estimate has increased the contained uranium metal in the deposit by 4,820t U3O8 or 45%, by Paladin directors which is regarded highly significant.

Analysis: I do not have the space to go into Paladin and the Kayelekera project in Malawi, but this certainly sounds like good news.

January 27, 2006: Paladin Resources Ltd (Paladin Close $2.85Cdn)

Paladin has secured a second sales contract for a portion of its yellowcake (U3O8) production from the Langer Heinrich Uranium Mining Operation, scheduled for commissioning in September 2006. This latest sales arrangement with a US utility is subject to finalisation of all necessary legal documentation. The sales contract is for the purchase of 2,080,000lbs U3O8 for delivery between 2007 and 2012. Pricing will be market related to be determined at time of each delivery with escalating floor and ceiling price components.

Analysis: Unless my math is horribly off, 2007 to 2012 encompasses six years of production. The sum of two sales contracts announced January 19th and 29th is a year-and-a-half's worth of production (remember, Paladin projects 2.6 million lbs/year). So they have managed to sell a quarter of their six year inventory before even mining a single pound of it. I'll leave everyone to draw their own conclusions about this..

Paladin's website has presentaions (Nov 2005) on both Langer Heinrich and Kayelekera. I have linked their .pdf files respectively.

Conclusion: To this day, Paladin has kept everything on track, met its deadlines, and have given me no sense that they do not have full control of the situation. I like their straightforward, easy-to-understand presentations, and am fairly confident of the people they have in place. I will not say whether or not to buy it at this moment in time as I am not a chart analyst, but if you are like me and am investing for the long run, Paladin would be a worthy inclusion into the uranium portfolio.

Disclaimer: I own shares in Paladin, buying them at an entry price of $2.30.

As always, please do your own due diligence. Scrounge for info and know more about the company you want to place your hard-earned money into!!

comments and suggestions are very welcome as always!

In August 2002, Paladin acquired 100% of Langer Heinrich Uranium (Pty) Ltd., the Namibian company holding the Project rights and completed a Pre-Feasibility study at a cost of US$ 1.26 million. This study was followed by a US$ 3.0 million Bankable Feasibility Study (BFS) that was completed in April of 2005. After full management review of the BFS, the Board resolved on May 9, 2005 to proceed with development of the project.

In August 2002, Paladin acquired 100% of Langer Heinrich Uranium (Pty) Ltd., the Namibian company holding the Project rights and completed a Pre-Feasibility study at a cost of US$ 1.26 million. This study was followed by a US$ 3.0 million Bankable Feasibility Study (BFS) that was completed in April of 2005. After full management review of the BFS, the Board resolved on May 9, 2005 to proceed with development of the project.