Several days ago Cameco came out with their Q3 numbers. This is what they have to say about Cigar Lake:

We anticipate that a phased plan will be in place within three months outlining a preferred option and several alternatives. Most of the alternatives under consideration involve drilling from the surface and isolating the source of the inflow from the underground workings by using grouting or freezing techniques and then pumping the water out of the mine. Discussions are under way with relevant authorities to review the incident and chart a regulatory path to ensure timely review of remediation plans. The existing environmental assessment of the Cigar Lake project allows for mine remediation from the surface in case of flooding.Now, some analysts have speculated that the Cigar Lake project has been delayed for at least two years and possibly longer. I am certainly not an engineer, but to need a few months just to devise a plan is an indication for me that two years might be a fair estimation.

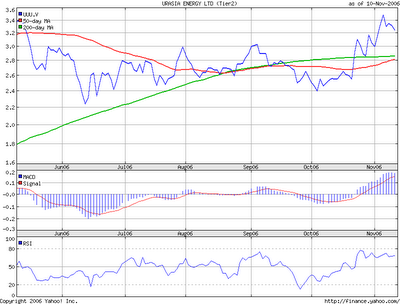

The short-term implications have already reverberated in resounding ways. Uranium stocks of every ilk have profited enormously, be it microcaps or billion-dollar uranium juniors. As long as the general market does not trend downward, uranium stocks seemingly have a limitless cap on potential for gain.

However, if one were to ask if this is the right time to buy, the answer is much hazier. Yes, there has been a fundamental change in each and every uranium stock because they more or less have a premium based on the uranium price and with the supply-demand fundamentals being skewed by a potential two year delay in a 17 million lb/yr project, I have no doubts that some of the appreciation in the last week is here to stay.

Still, I see a whole new wave of speculators coming into the uranium stock game now, who by virtue of Cameco’s bombshell has suddenly woken up to uranium investing and are throwing money into uranium stocks fairly indiscriminately. I see the signs of speculation around me: the sudden spike in my blog subscribers, upswing in various uranium stock bulletin boards, an uptick in search engine-directed activity into this website. And of course, these small uranium stocks themselves who are suddenly jumping 50, 100% in value over the course of a single week.

Now, the question becomes, when does this multi-digit gain stop? And when is the crash going to happen? Because, in my opinion, there will be a fall at some point. Take a look at what happened in April-May of this year. Yes, there has been a fundamental change, but no, that should not be applicable for every uranium stock out there. Simply put, I do not think that there will be two to three hundred uranium producers out there. Yes, many of them might be taken over, but one might not want to play such a risky game..

Be sure to sign up for 100% free, NO SPAM (unless you consider my writing junk!) email updates at the right of the screen! And leave comments! Let's talk U!