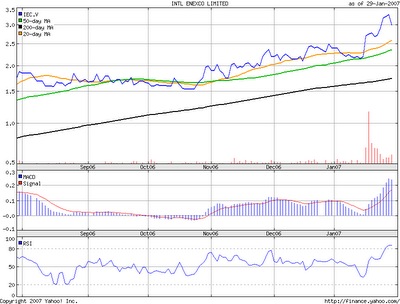

UR-ENERGY (TSE:URE) Quarterly Webcast(a) 342% return in 12 months

(b) believe they have 10,000 shareholders, 5X as much as a year ago

(c) financed 3 times: August ($500,000 and $18.75 million) and (November $2.5 million); company is very comfortable able to satisfy all 2007 obligations and some of 2008, can take advantage of market conditions for next financing

(d) fully diluted ~79 million shares with only ~270,000 warrants and 5.4 options

(e) average share volume >1 million last 3 months

(f) cash on hand $28.7 million, potential cash $38 million

(g) 43-101 compliant resources of 24 million pounds, 88 million pounds historical

(h) 2 major projects being permitted and engineered for ISR production

(i) filling a strategic production niche in the USA; <5% of USA supply from USA mines

(j) Bootheel and Radon Springs intermediate development projects after Lost Creek and Lost Soldier

(k) exploration projects Screech Lake, Eagles Nest, Harding, Kaycee, Radon Springs, North Hadsell, Bugs

(l) Lost Creek Project: expect this to be first producing project late 2008 with wellfield construction; permit to mine application ~June 2007

(m) Lost Soldier Project: expecting pump test results; in several different zones versus Lost Creek, will be more complex

(n) all permitting activities on schedule and within budget

(o) like to emphasize that they are company with full range of exploration, development and near-term production projects

(p) $6 million budgeted for Lost Creek and Lost Soldier in 2007, $1.5 million for exploration and land acquisition in US, $2.5 million for Canadian expenses

(q) in Q1 2007, announcement of signing of toll milling arrangement with plant operator in Wyoming and completion of independent pre-feasibility study on production projects

(r) announcement of JVs, strategic alliances anytime in 2007

Q&ALabor and Equipment?

good drill contractor, three drill rigs lined up to start in March, will not impede Lost Creek and Lost Soldier projects..continue to look for experienced people, is a bit of a problem, feel stretched in some areas but hiring regularly

US Listing?

they would have preferred to initiate process last year but decided not prudent use of funds..in 2007, want to expand retail distribution, expect application to be made within Q1..looking at both AMEX and NASDAQ, two frontrunners

Lost Soldier

average ISL leaching efficiency 68%; Lost Creek gives better leaching efficiencies, flow rates, seems to management to be somewhat simpler than Lost Soldier..makes sense to move Lost Creek first

Pre-Feasibility?

expect mid-year 2007, will put out summary of it, will be out before application to mine

Radon Springs

quite a lot of volume but low grade..geographic complexities that they were not quite ready to address yet..not first choice to moving forward with project, as much as grade as anything else..hope to have at least portions for ISL but still work needs to be done..

Bootheel Project

Southeast Shirley Basin project..2.7 million lbs historic resource, was owned by Cameco up until 2000..difficulty moving forward there is more of land problem than geologic, working with US land is not as easy as other countries..multiple mineral owners making more complex..feel close to having that solved..need to start drilling programs, testing them before do more planning

January 2006 Decision

would not move every project towards N43-101 resources..we felt that until a project is really ready to advance and move forward, not best time to use money and resources, lot of balancing, comparison between projects..intend on moving all projects in some manner, either moving to development stage or sloughing them off..

Selling Out vs Independent Uranium Company?

No comment

Potential Water Problems?

Obtaining water not particularly a problem, need to license wells, has not been a problem..ISL creates certain amount of bleed, somewhere in the range of 1.5-2% of total water produced..because of large volume, can be quite significant..can be taken by distillation, evaporation or deep injection..in the process of permitting deep disposal wells

ImpressionAs usual, Ur-Energy strikes me as having one of the most pragmatic, experienced, and transparent management teams in the uranium industry. Whether they will progress on their own or be tempted to sell out to a sweetened offer is almost irrelevant; their shareholders will profit either way. I firmly believe in this company and personally bought more shares when they were consolidating around the $3.70-$3.90 level.