Teasing out IAEA's "Analysis of Uranium Supply to 2050"

Why do I say that? Well, because if you're investing money, wouldn't you want to know specifics? Exactly why am I putting my money into Urasia? Exactly why you are willing to spend money on a very specific resource sector? If reading will give you knowledge of overall uranium conditions & outlook, and make you actually believe in what you're investing, spelled out for you by a reputable source (come on, this is the IAEA here), then I fail to see why you wouldn't go for it.

Enough preamble, let's take a look at some of my personal highlights of the IAEA presentation:

About Supply + Demand

Lead times to bring major projects into operation are typically between eight and ten years from discovery to start of production. To this total, five or more years must be added for exploration and discovery and for the potential of completing even longer and more expensive environmental reviews. Therefore it would most likely be no earlier than 2015 or 2020 before production could begin from resources discovered during exploration started in 2000. On the other hand, longer delays will reduce the likelihood that the entire resource base of a large new project will be depleted by 2050. Put another way, discovery of a major deposit in 2030 will have much less impact on alleviating the projected shortfall between production and demand than will a project that is discovered in 2005.

Analysis: This is why I am much more interested in investing in companies who are getting uranium out of the ground now. Not tomorrow, today. There are at least ten times the number of uranium companies in Canada now compared to a few years ago, many of them who are small juniors with just land claims to their name. Granted, there are a couple of promising exceptions, but would I really want to invest money into them? Personally, no, because I don't have enough to throw at 10 non-producing juniors and hope some of them actually strike it rich or get bought out.

In terms of discovery to production time, every country is different. Australia has the tightest regulations, Canada and the States take years. Other countries are faster. Case in point, the joint venture between Kazakhstan and Japan, freshly minted, will start pilot production as early as 2007 and full production in 2010. That's only four years.

One of the things that strikes me when I peruse the Internet for uranium news is how many companies are planning on opening uranium mines in the near future (aka several years). While I do believe that uranium prices will go up, I suspect that overall uranium production will be able to match demand sooner than people think. This, however, just reinforces my belief that the best time to invest in uranium is right now, with the right company that can take advantage of this lag time.

About Uranium Type

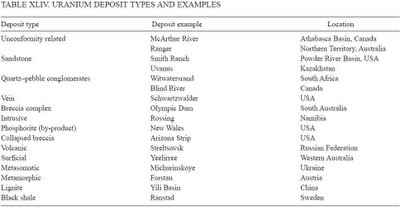

Uranium deposits have been broadly grouped into 14 categories. Two types— unconformity related and sandstone — are considered to have the best potential to host significant SR.

Unconformity related deposits account for 18% of study RAR, but only 8% of the deposits or deposit groups included in study RAR, which is an indication of their high ore grade and resource potential. The largest known high-grade deposits in the world are located in the Athabasca Basin in northern Saskatchewan, Canada, including McArthur River (184 200 t U, average grade 12.6% uranium) and Cigar Lake (138 800 t U, average grade 11.5% uranium); both are unconformity related deposits.

The Athabasca Basin in Canada and the Northern Territory, Australia, host significant unconformity related resources, and they are both considered to have good potential for additional discoveries, even of the magnitude of McArthur River, Cigar Lake or Jabiluka.

Sandstone deposits: uranium deposits hosted in sandstones account for nearly 30% of the study RAR. Production from sandstone deposits is the cornerstone of the uranium industries of Kazakhstan, Niger, the USA and Uzbekistan. Areas considered to have the best potential for the discovery of significant new sandstone resources include:

—The Trans-Baikal region (valley type deposits) in the Russian Federation and northern Kazakhstan;

—The Gobi Basins in Mongolia;

—The Lake Frome Basin in Australia;

—The Yili, Junger and Erlian Basins in China;

—The Karoo Basins in southern Africa and Madagascar;

—The Franceville Basin in Gabon.

Analysis: What this means is that not all uranium is equal. And what this also implies is that Cameco is not going to leave the uranium landscape for a very very long time!

As always, please do your own due diligence. Scrounge for info and know more about the company you want to place your hard-earned money into!!

1 Comments:

same around the world? might not be exactly true, but let me check up on that =P

Post a Comment

<< Home