Jan 28 Uranium Stocks Update: Urasia Energy (CVE:UUU )

(1) Canada has an all-business channel called "Report on Business" aka ROBTv. On January 25th, they had a guest analyst come on a segment called "Stars and Dogs", where they pick out stocks they liked and ones they didn't. On the "stars" list was Urasia. If you'd like to watch the segment, here is the link. (ROBTv has a website where you can watch previous episodes)

Lawrence Roulston was the guest and I did a little digging on him. Turns out he is the editor of a publication called Resource Opportunities, a subscriber supported publication dedicated to providing objective commentary on the resource industry. Now I can't exactly judge his credentials, if you're interested, you can check out the site. He has been on ROBTv several times in the past, including three times in 2005 so somebody must like him..

(2) Urasia is seeking to be listed on the TSE Exchange. Now, why would graduating from the Venture Exchange help? Think exposure. Think institutional buying. Because, to my knowledge, no big name analysts are covering UUU at this point.

Case in point, I bought a junior oil called Arawak that had its operations in Kazakhstan, Azerbaijan, and Russia. This was after the PetroKhazakhstan acquisition and I was interested to see if any other Canadian-listed operators were there.

Arawak has since done well for me (it also acquired other companies back when oil was still reasonably priced and thus were in good position to take advantage of rising prices) and has recently begun to acquire institutional coverage (Morgan Stanley has been buying up its shares like crazy). Still on the Venture, but inching up towards a TSX listing.

May UUU follow such a course!

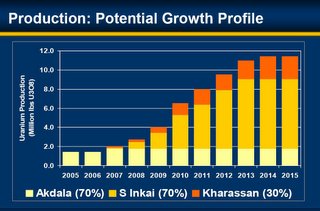

(3) I found a November 15, 2005 PDF Urasia presentation. This is one of their slides detailing estimated production down the line. It's a good read so here's the link

(4) Price Targets. I have no personal price targets right now because I intend to hold UUU for a very long time (at least >1 year). However, here's the article on Goldeditor with someone else's price target. Apparently, Jordan Funds (this investor club in Sweden that I know really nothing about..you can check out their site here) had this to say:

Jordan Funds 2-3 year target: CAD $15 per share at USD 40 lbs/U308. Perhaps more realistic is Uranium at USD 80/lb within 2-3 years according to JF, the classic “the sky is the limit” prevails, or in Swedish, “do your homework” and take a strong look at UUU. For someone who is new in the uranium industry, UUU means high risk, for someone who knows more about the industry it means more like high chance. JF believes that UUU should be ranked in JF’s division 2 group as the top pick. As early as the year 2007, they may be among the world’s top 5 and perhaps in the upper half of the five foremost uranium companies in the world. (I.e. UrAsia, Kazatomprom, Cogema, Cameco and ERA) JF has meticulously and in a detailed manner gone through the uranium industry specifically, as well as the foremost companies. The 5 mentioned are “the big ones” in the future. Close behind the division 2 gang with less production in view, but still should also be profitable within a short period are: Laramide, Aflease, Southern Cross, Paladin, Uranium Resources, IUC, Denison and maybe Strathmore and UEX. Other companies in this sector can all be classified as high risk companies with accompanying chances and risks.

Right now - UUU.V is Jordan Funds top Uranium stock pick.

Analysis: I really don't know what "meticuously and in a detailed manner" really means but it is interesting to note that if you check out Jordan Funds' site (or Jordanfonden, because they are, well, Swedish) they have stakes in other uranium companies so that says something about UUU. Maybe not a whole lot to you and I, but something =P

As always, please do your own due diligence. Scrounge for info and know more about the company you want to place your hard-earned money into!!

Trivia: guess which country is Kazakhstan's easterly neighbour?

Uh huh, It's China..

Comments are very very welcome, especially those from the regulars @ Stockhouse!

6 Comments:

GOOD JOB!!!

How about putting an RSS feed on your blog

Thanks

prisser

GARR...i am back again

Really well done on this one.

UUU seems to be a long term investment, it really depends on the price of the Uranium. I am not quite sure how drastically the price of Uranium will move up, but it is defintly on the upward trend.

Here is a question for u, 1)what makes u think UUU and Arawak are working towards to get listed on TSX? any kind of source or links?

2)I dunno to much about Arawak, but maybe you can share abit of history on this stock and how well this stock has worked for u.

i'll try to set up an RSS feed within a short time but i'm not as tech savvy (hey, i'm on blogger aren't i?) person in the world so let me do some due diligence on how to set up RSS first. thnx for the suggestion tho, appreciate it!

Jordanfund is a good place to visit if you are interested in minerals and oil, uranium will be extremely hot as the oil becomes rare..

sincerely;

/trOtte

with respect to oil, i'd like to see the impact that unconventionals (mostly oil sands) has on supply/demand.

Post a Comment

<< Home