Japan + Kazakhstan --> Stock Uranium as China Looms

Ikuko Kao of Reuters News Service reports:

"Japanese firms are boosting investment in uranium sources in Central Asia as a revenue stream, since an expected surge in global demand for nuclear fuel is likely to keep prices at record-high levels"

Analysis: yes, the price of spot uranium is up to $36.5/lb, and shows no signs of slowing down. Simple supply and demand economics. Price is expected to shoot up to $45 next year. Some of the more adventurous analysts have speculated that it could go up to $500/lb. But let's just keep it conservative and say the probability of uranium price getting higher is very likely and that it will go lower, not so much. There is just not enough production right now; less than 10 companies in the world are actually getting uranium out of the ground.

Sumitomo Corp. and "Kansai Electric Power Co., Japan's third-largest trading firm and second-ranked utility, agreed on Monday with Kazakhstan's state-run KazAtomProm to jointly develop a uranium deposit in the country"

Analysis: why on earth would such big companies in Japan ever be interested in Kazakhstan?

"It's very important to look beyond oil to find a new income source especially when uranium prices are almost promised to rise to new highs," a spokesman at Sumitomo said.

Resource-poor Japan imports almost all of its oil and gas needs and has a government policy of supporting nuclear power with an aim to build five new nuclear power plants by 2010."

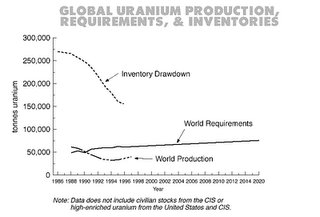

Analysis: it's true. Nuclear power supplies 20% of the electricity in this world. That is a ton of power. And there's only so much supply. We are actually not producing nearly enough uranium right now to supply demand, but the deficit is being made up by converting old Soviet weapons. Unfortunately, that particular agreement ends in about eight years. Supply will even be stretched further, as new nuclear plants are being built. But by who?

"Japan will still have to import uranium and wants to avoid competition with China, which has also been rushing for stakes in projects and to secure resources to meet energy demand.

"We need to secure uranium stakes before the competition with China starts over again," the Sumitomo spokesman said. "

Analysis: and there it is. Just as China (and India) is driving the oil boom, it also will drive the uranium market. China is planning to build 2 new power plants every year for the next twenty years. Other countries around the world are doing the same thing (although not nearly as drastic) and others still are contemplating whether or not to delve more into nuclear power (whole other discussion). If you can imagine that with only 440 or so power plants right now, more being built, and supply destined to drop off rather sharply until a massive amount of production is undertaken some time in the future, you can understand why uranium investing makes some sense.

7 Comments:

Nice blog. Are you goign to suggest some TSX or ventures stocks for your log readers to take a look at?

indeed i will! feel free to post suggestions on your fav stocks too. after all, we're all in this together

Sure. I will share with you what i have already bought for the uranium stock.So far, i bought only UUU. And i heard lots of ppl are saying this stock might be going high soon.

lol. this is just gravy because i bought UUU as well and am just finished doing a piece on it. please feel free to add suggestions!

you list out some very intruiging companies charlotte.. i agree with your strategy of picking up producers or will-shortly-be producers. I haven't made up my mind on really big companies like Cameco and BHP Billiton yet..sure, they might not increase in the way that microcaps or small caps might, but the risk is substantially less and they are sitting on some of the world's biggest and best uranium deposits.

all pics are great what are the chances of market crashing. Any one please put out your insights. Is there going to be a market crash?

Bhp is on the news alot. What is your input

Post a Comment

<< Home