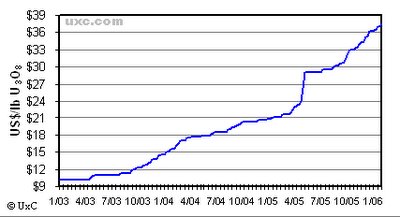

3-year Uranium Oxide Price

This is why we invest in uranium. Without an understanding of this, it would be an impossibility to justifiably advocate uranium mining stocks. A couple of points I like to remind everyone about uranium versus other commodities like gold and copper are:

(1) the uranium supply and demand market is very small. One does not need to spend much time in figuring out those who use and buy uranium and those who produce and sell uraniium. There have been a few wrinkles to this equation (namely the parties who buy but do not use) but the point here is that the fundamentals of uranium oxide are very easy to understand.

(2) have you notice ANY downward trend in this graph? Me neither. For all of its doubling in the last couple of years, gold has had its share of ups and downs. Now don't get me wrong, I'm invested in gold as well, but my point is that uranium oxide price per pound has quadrupled in the past three years, and is showing no signs of slowing down.

(3) uranium oxide producers like Urasia are spending $7-8 to mine one pound of uranium oxide, but can fully take advantage of the ascent of the uranium oxide price. Understand that there are other costs to be taken care of and taxes to pay, but to have that kind of differential between selling a pound of uranium oxide to how much it costs to bring it out of the ground will produce profitable margins that are getting wider by the day.

(4) the general public does not know uranium. They know about oil now, yes, and are coming to know about gold. Do they know uranium? Beyond news about Iran and the vague plans of Bush to de-addict the United States to oil, I would strongly argue against any pre-existing mass enlightenment of uranium and nuclear power in general.

6 Comments:

Hello!

I've been visiting your site for a while now and was sad when you left to join the other blog. I'm glad you're back and are posting again!

I am a huge believer of uranium - too many smart people believe the same and who am I to go against them? There are so many juniors with cow pastures out there and your blog brings to investors much needed information to help us sift through the cr@p! Thank you!

thnx for your support! i had the same "there are so many companies out there" feeling when i first got started in uranium so i'm glad this is helping some people out. as always, try to do your own due diligence and be comfortable with whichever stock you buy!

i have no problems with BHP. in fact, i think BHP and Cameco are very very very well-run companies. they are the ones with the greatest chance of being recognized by the masses, and we all know how investing psychology often is influenced by those masses. i just have a personal penchant for the best of the juniors out there =P

I'll have to do more searching about BHP. Cameco is a very well run company, but its multiples are WAY too high. My opinion is that CCO is the only 'go to' name for institutional and large investors. After CCO, there really aren't that many producers. Now CCO is a great company, but trading at 80x P/E, man, that's really really pricey. My understanding is that their hedges don't even fall off until after 2008!

Eventually, companies like PDN and UUU will get more attention as they start to ramp up production. Investors will want to diversify out of CCO and those companies that you've listed will be the ones that are the most likely to get attention.

(I also got tired of hearing about NUC.) I like how you post mainly facts and well thought out opinions rather than just "wow, look at my portfolio!" or "look, i'm going to marry this stock because i'm in love with it" etc.

Thanks again!

Thanks for the information on BHP, charlottebandit. I looked at BHP over the weekend and like what I saw. However, other than the uranium holdings, I am still leaning towards Teck Cominco as the diversified play. Does anyone know BHP's sensativity to increasing/decreasing prices of uranium?

Does anyone know the difference between the tickers BHP and BBL? Both look like ADRs, but one's price is cheaper than the other. BHP looks like the one that trades more and is more liquid, but BBL looks slightly cheaper? Is it mispriced? According to the website, BHP Billiton Ltd. and BHP Billiton PLC have the same structure and rights to the overall company. Why wouldn't one purchase BBL over BHP?

Post a Comment

<< Home