Feb 3 Uranium Stocks Update: Paladin Resources (TSE:PDN)

February 1, 2006

Paladin Resources Ltd: Prospective Tenements Granted Adjacent Kayelekera Uranium Project, Malawi

"Paladin Resources Ltd is pleased to advise that the Minister of Mines, Natural Resources and Environment has granted three Exclusive Prospecting Licenses (EPL) in northern Malawi to its wholly owned subsidiary Paladin (Africa) Limited (PAL).

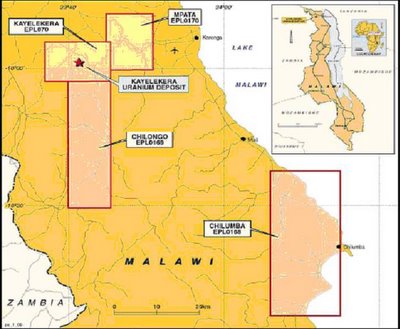

Figure 1 shows the location of the three new EPL's (Nos. 168, 169 and 170) and in total these cover 1,140 km2. Two licences are contiguous with the Kayelekera EPL070, while the third licence stretches along a coastal section of Lake Malawi.

The area covered by EPL170 has been previously investigated which included the carrying out of geophysical airborne surveys and limited ground follow-up programs. These earlier investigations were carried out during the 1980's by the British Central Electric Generating Board (CEGB), the group that discovered and evaluated the Kayelekera deposit up to a full feasibility study. The tenements cover anomalous areas delineated by CEGB. The large number of airborne radiometric and geochemical anomalies identified on these properties are associated with the target geological formations that host the Kayelekera deposit.

Only EPL170 underwent some follow-up exploration and this tenement area is considered to hold the greatest potential for uranium. CEGB drilled 49 holes (30m to 100m depth) to check 10 anomalous areas and 31 intersected numerous low order mineralisation including a maximum of 0.5m at 0.2% U3O8 and identified the existence of critical Redox fronts. The occurrence of such uranium mineralisation and presence of oxidised and reduced rocks in association, is regarded as highly favourable and confirms that mineralising systems operated which were similar to those that generated the Kayelekera Uranium Deposit.

The extensive prospective areas offered by these tenements provide Paladin with a significant opportunity to expand the existing uranium resource base of the project and has the potential to make any mining operation at Kayelekera a strategic facility for longer term utilisation and benefit.

Analysis: Good news. Years ago, CEGB had found the same type of uranium in EPL 170 as it did in Kayelekera. Considering that the uranium deposits are right next to each other, is that really surprising?

Paladin's plan for Kayelekera is to have an annual production of 1,000 tons/year of uranium oxide (2 million pounds/year) with a mine life of 10 years as it is estimated that there is roughly 22 million pounds of uranium in that area. These numbers are being verified in the Bankable Feasibility Study (BFS) with the results expected around November of this year. If everything goes according to plan, Kayelekera is scheduled to begin producing uranium in 2008/2009.

When I eyeball the uranium exploration licenses handed out to Paladin on the map, I'm quite impressed by their sizes. 1140 kilometers squared is close to 300,000 acres. With time, I am quite sure that there will be a future announcement pertaining to exactly how much more uranium reserves Paladin will add on because of these licenses.

However, at present, I am most interested in their development of the Langer Heinrich

0 Comments:

Post a Comment

<< Home