David Miller on RoBTV

Miller's first prefaced his key observations of the uranium sector by establishing some credibility:

"I started my career in uranium in 1976 in the previous boom"

"I think it's (uranium boom) stronger than in the 1970's"

Key Points

(1) right now, uranium is finally entering the market as a commodity

(2) we've consumed all the excess uranium available

(3) in 1985, consumption started > production

(4) since 1985, consumption steadily increased

(5) half the power generated by nuclear in the US comes from Soviet weapons

(6) demand for uranium comes from ~440 nuclear plants

(7) current production 105 million lbs

(8) current demand 180 million lbs

(9) China, India, Russia main drivers for new nuclear plants

(10) needs to become acceptable around the world

(11) clean, plentiful, no carbon dioxide

(12) spent fuel rods needs reprocessing

(13) need regulation

(14) don't rely on anyone, do your own due diligence

(15) uranium needs organization to be traded as a commodity (futures)

(16) nuclear utilities worried about security of supply, signing long-term contracts

(17) current long-term price $51, spot price $53.5 U3O8

(18) only 4-5 dozen players setting uranium oxide price, small market

(19) cost of uranium fuel very tiny fraction to cost of running nuclear power plants, uranium oxide price can double with minimal impact

(20) uranium not really tied to other energies (coal, oil, natural gas)

Analysis

Yes, Mr. Miller has been in the uranium business for decades now, and brings along a wealth of experience and insight. The book is probably a good read for newer uranium investors.

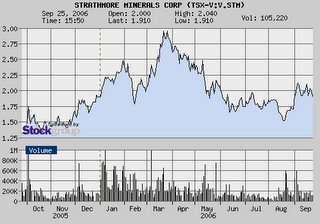

However, I'm more curious as to Mr. Miller's company, Strathmore Minerals (STM.V). The company promotes itself as having one of the largest exploration land packages in the prolific Athabasca Basin along with additional holdings in the United States, Canada and Peru. Historical estimates of reserves (some are not NI 43-101 compliant) on several of their properties are impressive but the stock price has staggered along for some months now, even with the publicized backing of Mr. Miller, Sprott (Kevin Bambrough) and Halcorp Capital (Mike Halvorson).

Some months ago, Strathmore and Ur-Energy (URE.TO) had roughly the same market capitalization; currently, Ur-Energy is more or less valued at $50 million more. The difference, in my opinion, lies in the perception that Ur-Energy will be a uranium producer in Wyoming faster than Strathmore will be in New Mexico with its Church Rock Project. Whereas Ur-Energy has set some very definite goals for its Lost Soldier and Lost Creek project, Strathmore seems to be comparatively late in joining the mid-tier uranium junior-to-uranium producer progression that accompanies with it a substantial revaluation in market capitalization.

This is not to say that Strathmore is a bad company. If permitting goes smoothly at Church Rock, the company stands to gain back some ground. Meanwhile, a little publicity for Strathmore and the whole Canadian uranium industry courtesy of Mr. Miller obliges this uranium blogger to thank him.

3 Comments:

of the ones i've picked, i currently like ur-energy and forsys, although they are going to have more volatility than the others. having said that, i would be just as comfortable putting money long-term (say, 2-3 years) on any of them..make sure you do full due diligence and be comfortable in making the call!

I like Kilgore's tight share structure and experienced management team; the company seems to have its hands on many different ventures, thus distributing risk to some extent. however, it is still a highly speculative play..and remember, the book you are referring to is biased (which book isn't) by the interests of their authors..i'd suggest doing your own DD, perhaps to the point where you can persuade yourself why you want to buy Kilgore over another junior uranium play of roughly the same market cap

Nice work here! I picked up a copy of "Investing in the Great Uranium Bull Market" at the Toronto conference a week ago. Agreed that the authors have their own biases (they are compensated by several uranium companies). That said, I believe it will be useful to me in evaluating investment opportunities in this sector. For example, I know quite a bit more about ISR today than I did yesterday.

Post a Comment

<< Home