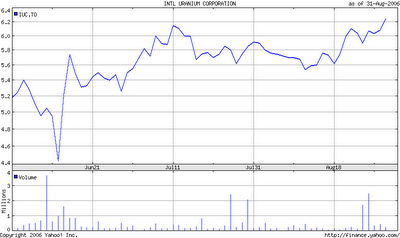

Sep 1 Uranium Stocks Update: International Uranium Corporation (TSE:IUC)

The company released a MD&A in mid-August so let's see what they have to say in their outlook:

In June 2006, the Company announced the re-opening of a number of its U.S. uranium/vanadium mines. Mining is scheduled to begin during the fourth quarter of 2006 with mined ore stockpiled at the Mill. The Company plans to begin development activities on one mine and commence mining operations at three other mines, all on the Colorado Plateau.

Basically, IUC and Paladin Resources are both going to be producing U3O8 at roughly the same time. Uranium oxide is trading close to the $50/lb mark and vanadium, exclusive to IUC, is around $8-9/lb.

The Mill is continuing to process alternate feed material and is expected to produce approximately 500,000 pounds of U3O8 from the processing of a high-grade alternate feed material, of which approximately 210,000 pounds are scheduled to be produced during 2006. The current mill run began in March 2005 and is anticipated to last through to the second quarter of 2007. The Company does not have any fixed contracts for this material and will evaluate commercial opportunities for sale of the material throughout the year.

Even without the restart of uranium mining, IUC has half a million pounds of U3O8, which at current market price represents roughly $25 million US.

The Company’s exploration programs continue through 2006, both in Canada and Mongolia. Currently, the Company has two drilling programs underway at the Moore Lake Joint Venture and Park Creek project. In addition to the drilling programs, the Company has significant field programs on a number of its properties.

Just today, IUC announced the starting of drilling on Consolidated Abaddon's (CVE:ABN) Sims Lake uranium project in western Labrador. IUC has the right and initial option to acquire a 51% interest in the uranium rights to the Sims Lake property over a period of two years.

With prospects continuing to look bright for IUC, insider buying has also picked up:

Ellegrove Capital Ltd., a Barbados resident company, through its joint actor, has acquired 1,985,500 common shares of International Uranium Corp. As a result of this acquisition, Ellegrove, together with its joint actors, holds as at the date hereof, a total of 12,982,000 common shares, which total holdings represent approximately 14.67 per cent of the issued and outstanding shares of IUC.

Ellegrove is owned by a trust, of which trust's settlor is Adolf H. Lundin.

Lundin is part of IUC's board.

Of all the uranium stocks I have recommended, IUC to me seems to have the greatest disparity between intrinsic and actual value. At $550 million, it behooves me to find it beneath the market cap of a company like Aurora Energy TSE:AXU, who admittedly has great uranium properties but will not mine a lick of it for years.

0 Comments:

Post a Comment

<< Home