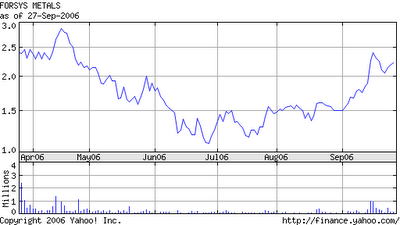

Sep 28 Uranium Stocks Update: Forsys Metals (CVE:FSY )

Since my last update on Forsys almost two weeks ago, the company announced that it has received the conditional approval of the Toronto Stock Exchange (TSX) to list the common shares of Forsys on the TSX.

I continue to think highly of this company and, with a TSX listing, institutional investors might start piling in too. As you all know, major financial institutions like RBC, CIBC, Scotia and Deutsche in the last few weeks have all had to revise and raise upward their forecasts for the uranium oxide price. Multiple analysts have remarked that uranium and gold seem to be the safest of resources to invest in because of their uniqueness: uranium has a supply-demand imbalance even worse than zinc and gold trades as money.

Now as I see it, of the several hundred uranium companies listed in Canada, only a fraction are on the TSX while the bulk of them, including Forsys, currently reside in the Venture Exchange. If you screen out those companies that do not have uranium as their primary asset (eg Globex Minerals, a company dealing with gold, copper, zinc, silver, platinum, palladium, magnesium and talc as well as uranium), I can only find a handful of pure uranium plays out there.

The companies that are both largely pure-play uranium and listed in the TSX are the comparative goliaths of the uranium industry; recognizable names like Cameco (TSE:CCO), Paladin (TSE:PDN), SXR Uranium One (SXR.TO), UEX Corp. (UEX.TO), Aurora Energy (TSE:CCO), International Uranium Corp (IUC.TO), Denison Mines (DEN.TO), Uranium Participation (U.TO), Mega Uranium (MGA.TO), Energy Metals Corporation (EMC.TO), and Ur-Energy (URE.TO). I list them in descending order of market cap, with Ur-Energy being the smallest at roughly $196 million.

As far as I can tell, there is only one other uranium pure-play (could be several more, but you get my point) with a lower market capitalization than Forsys ($101.7 million); that would be High Plains Uranium (HPU.TO), a $48.7 million company that is about to be taken over by EMC.

The corollary to this observation is that the all of these companies are either producers of uranium (Cameco, Paladin, IUC, Denison), near-producers of uranium (SXR), or have advanced-stage projects complete with feasibility studies that should let them produce uranium within two to three years (UEX, Mega, Ur-Energy).

So what does this mean for Forsys? Well, if institutional investors start making good on their word about being bullish on uranium, money will be piling into uranium stocks (so far, it's somewhat puzzling why stocks have not nearly appreciated as much as the uranium spot price itself). However, Venture Exchange uranium stocks are a dime-a-dozen. The ones that trade on the TSX generally will receive more attention and investor backing, simple as that.

1 Comments:

U.TO sells at a premium to its NAV yes, but as long as the price of uranium oxide continues to climb (no indications it won't for at least another year), then investors will continue to feel comfortable buying U.TO at a slight premium..there are other uranium ETFs out there, but U.TO is the only one in Canada..

Post a Comment

<< Home