Nov 12 Uranium Stocks Update: Urasia Energy (CVE:UUU )

Urasia signed five new contracts to sell its uranium to North American utilities that totals 5.75 million lbs over a span of nine years all the way to 2016. As expected, these contracts are subject to changes in uranium price, as uranium producers like Urasia and Paladin pride themselves on being unhedged. Urasia CEO Phillip Shirvington attributes these five new contracts in part to the Cameco Cigar Lake disaster, which has obviously scared those who rely on the use of physical uranium to sign these long-term contracts.

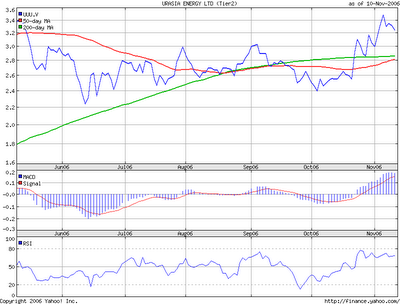

As you can see from the stock chart, Urasia has appreciated along with all other uranium stocks not named Cameco in the last two weeks or so, rising to $3.25 from a trough of $2.40. MACD and RSI remain positive, although it remains to be seen whether or not there will be a golden cross, as the 50DMA seems to have trouble breaking above the 200DMA. While this announcement of new contracts is positive, I remain concerned about Urasia's foreign exchange losses, and nothing in the last few months has convinced me otherwise. To an extent, the lack of transparency of Urasia as compared to Paladin (TSE:PDN) for example, has led many institutional investors to opt for Paladin as a first alternative to Cameco (that and Uranium Participation Corporation). I would hope that Urasia will be more forthcoming and directive in their communications to existing and potential investors.

1 Comments:

nice blog man. I have one that is similar, but i think that yours is very comprehensive and professional. I take it you are a professional trader or investor or something. Anyway keep up the good work I am expecting more intersting article.

Post a Comment

<< Home