8th Uranium Stocks Pick: International Enexco (CVE:IEC)

International Enexco (CVE:IEC)

Shares Outstanding = 16,674,651

Shares Fully Diluted = 24,562,057

Mann Lake Project

30% owned by IEC

35% owned by Cameco (NYSE:CCJ TSE:CCO), primary operator

35% owned by UEM

Located 30km from Cameco's McArthur mine (then again, who isn't close?), this project has gone unnoticed by virtually everyone in the uranium investing community until recently. However, summer 2006 drill results were arguably the most impressive out of any uranium explorers, drilling two holes totalling 1,259m with two highest grade intervals averaging 7.12% over 0.25m and 5.53% over 0.4m. Granted, these are over small distances, but the sheer uranium concentration was beyond anything reported that drilling season. This year, the exploration budget has been raised to $1.5 million, with an addition 7-8 drilling holes that should be completed by the summer. Expertise is not an issue, with uranium powerhouse Cameco assuming responsibility as primary operator of the project.

Contact Property

In addition, IEC also owns the Contact Property in Nevada, a project with NI 43-101 compliant resources of ~150 million indicated and another ~250 million inferred pounds of copper and 3.7 million ounces of silver that is currently being developed with the intention of mining the base metal. On January 10, 2007, they announced the commencement of phase one of a three-phase drilling program, with the planned purpose of the next two phases to upgrade resources from indicated and inferred to measured and indicated, paving the way for pre-feasibility studies and other pre-production processes. Phase one is expected to finish late March of this year and IEC will report results as soon as they can. Production optimistically is aimed at late-2009

Most Recent Insider Trades

Jan 9 Lloyd Bray Acquisition 20,000 @ $2.15

Jan 15 Arnold Armstrong Acquisition 8,100 @ $2.10

Jan 17 Paul McKenzie Acquisition 16,500 @ $1.50

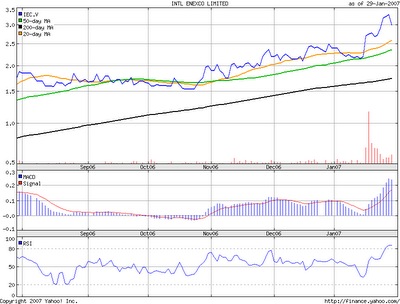

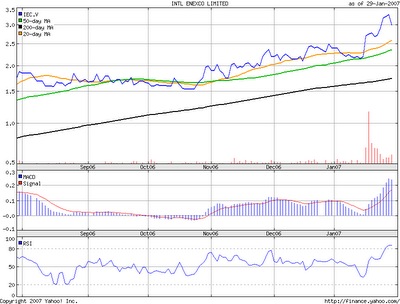

IEC closed an $8.9 million January 5th and currently has $16 million in working capital. As you can see, the stock is locked into a long-term bullish trend, a series of progressively higher lows and higher highs, and just recently broke sharply to the upside on massive volume. It seems that word is finally getting out on this small uranium explorer with potential for striking highly concentrated uranium. With Cameco doing the work and the uranium gurus at Sprott owning roughly 10% of the company (as of October, 2006), and possessing an actual copper asset in addition to uranium prospects, International Enexco seems to be well-positioned for a continued run in 2007. CEO and President Arnold Armstrong directly and indirectly owns ~4 million shares and the rest of the management team and director own various chunks as well; there seems to not have been any insider selling that I could find

All in all, IEC is obviously the most speculative uranium play that I have recommended, but could represent a nice opportunity to invest in a cheaper explorer that has yet to gain widespread exposure, even in the mainstream uranium investing community, but with tremendous potential secondary to impressive past results.

Shares Outstanding = 16,674,651

Shares Fully Diluted = 24,562,057

Mann Lake Project

30% owned by IEC

35% owned by Cameco (NYSE:CCJ TSE:CCO), primary operator

35% owned by UEM

Located 30km from Cameco's McArthur mine (then again, who isn't close?), this project has gone unnoticed by virtually everyone in the uranium investing community until recently. However, summer 2006 drill results were arguably the most impressive out of any uranium explorers, drilling two holes totalling 1,259m with two highest grade intervals averaging 7.12% over 0.25m and 5.53% over 0.4m. Granted, these are over small distances, but the sheer uranium concentration was beyond anything reported that drilling season. This year, the exploration budget has been raised to $1.5 million, with an addition 7-8 drilling holes that should be completed by the summer. Expertise is not an issue, with uranium powerhouse Cameco assuming responsibility as primary operator of the project.

Contact Property

In addition, IEC also owns the Contact Property in Nevada, a project with NI 43-101 compliant resources of ~150 million indicated and another ~250 million inferred pounds of copper and 3.7 million ounces of silver that is currently being developed with the intention of mining the base metal. On January 10, 2007, they announced the commencement of phase one of a three-phase drilling program, with the planned purpose of the next two phases to upgrade resources from indicated and inferred to measured and indicated, paving the way for pre-feasibility studies and other pre-production processes. Phase one is expected to finish late March of this year and IEC will report results as soon as they can. Production optimistically is aimed at late-2009

Most Recent Insider Trades

Jan 9 Lloyd Bray Acquisition 20,000 @ $2.15

Jan 15 Arnold Armstrong Acquisition 8,100 @ $2.10

Jan 17 Paul McKenzie Acquisition 16,500 @ $1.50

IEC closed an $8.9 million January 5th and currently has $16 million in working capital. As you can see, the stock is locked into a long-term bullish trend, a series of progressively higher lows and higher highs, and just recently broke sharply to the upside on massive volume. It seems that word is finally getting out on this small uranium explorer with potential for striking highly concentrated uranium. With Cameco doing the work and the uranium gurus at Sprott owning roughly 10% of the company (as of October, 2006), and possessing an actual copper asset in addition to uranium prospects, International Enexco seems to be well-positioned for a continued run in 2007. CEO and President Arnold Armstrong directly and indirectly owns ~4 million shares and the rest of the management team and director own various chunks as well; there seems to not have been any insider selling that I could find

All in all, IEC is obviously the most speculative uranium play that I have recommended, but could represent a nice opportunity to invest in a cheaper explorer that has yet to gain widespread exposure, even in the mainstream uranium investing community, but with tremendous potential secondary to impressive past results.

0 Comments:

Post a Comment

<< Home