Feb 14 Uranium Stocks Update: Ur-Energy (TSE:URE)

The Case for Ur-Energy

As we digest the completed merger of IUC and Denison and the coming merger of sxr Uranium One and Urasia Energy, consolidation activity in the uranium sector will only accelerate as emerging seniors look for accretive value. Although I still believe that the proposed SXR/UUU senior Uranium One will perform well, despite the added political risk as suggested by some analysts, the upside of its stock will take time to realize, much in the same way that Denison Mines (TSE:DML) seems to be base-building at present.

In fact, I see more immediate value in some of the uranium juniors, especially those with production visibility. Of course, one of my past picks, Ur-Energy, comes to mind. Here is a list of uranium juniors with market capitalizations in its vicinity:

JNR Resources (CVE:JNN) 259.8M

Western Prospector Group (CVE:WNP) 261.3M

Strathmore Minerals (CVE:STM) 295.3M

Ur-Energy (TSE:URE) 297.6M

Strateco Resources (CVE:RSC) 297.8M

Tournigan Gold Corp (CVE:TVC) 326.7M

URE, with its scheduled uranium production via ISL in Wyoming by 2008, is probably the earliest uranium miner out of the entire group, and to me, represents the best takeover target for any emerging senior uranium looking to add uranium projects that will actually come on-line in a relatively short period of time to capitalize on current prices. To compare, JNR and Strateco are exciting exploration plays, to be sure, but the prospects of actually mining the uranium out are years away.

Some have complained that URE does not promote itself as well, and in truth, it seems like there is a certain amount of truth to it; Paul van Eeden comes on RoBTV regularly to talk about Strateco and Strathmore has its own stable of publicists.

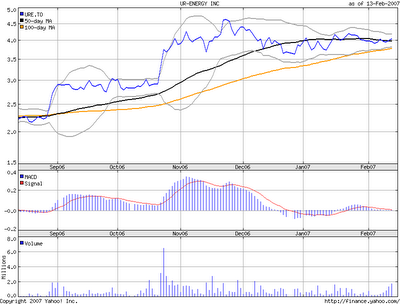

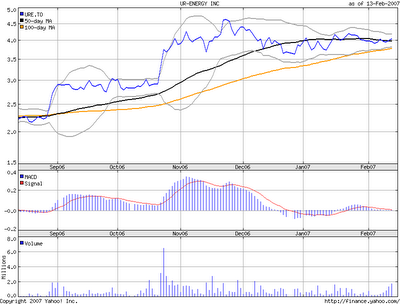

In any case, a look at the six month chart of URE shows two sharp rises followed by several months worth of consolidation and steady accumulation; Bollinger Bands in recent months have increasingly narrowed due to decreased volatility. The last few months have formed what might be interpreted as an ascending triangle, which if true, would be a bullish indicator. Volume has also picked up in recent days after contraction in recent months, culminating in today's 9% rise to $4.40 on three times the normal trading volume. We might indeed be witnessing the next sharp rise in URE, which hopefully, would knock out the old high of $4.70.

Thus, technically and fundamentally, I continue to like Ur-Energy.

As we digest the completed merger of IUC and Denison and the coming merger of sxr Uranium One and Urasia Energy, consolidation activity in the uranium sector will only accelerate as emerging seniors look for accretive value. Although I still believe that the proposed SXR/UUU senior Uranium One will perform well, despite the added political risk as suggested by some analysts, the upside of its stock will take time to realize, much in the same way that Denison Mines (TSE:DML) seems to be base-building at present.

In fact, I see more immediate value in some of the uranium juniors, especially those with production visibility. Of course, one of my past picks, Ur-Energy, comes to mind. Here is a list of uranium juniors with market capitalizations in its vicinity:

JNR Resources (CVE:JNN) 259.8M

Western Prospector Group (CVE:WNP) 261.3M

Strathmore Minerals (CVE:STM) 295.3M

Ur-Energy (TSE:URE) 297.6M

Strateco Resources (CVE:RSC) 297.8M

Tournigan Gold Corp (CVE:TVC) 326.7M

URE, with its scheduled uranium production via ISL in Wyoming by 2008, is probably the earliest uranium miner out of the entire group, and to me, represents the best takeover target for any emerging senior uranium looking to add uranium projects that will actually come on-line in a relatively short period of time to capitalize on current prices. To compare, JNR and Strateco are exciting exploration plays, to be sure, but the prospects of actually mining the uranium out are years away.

Some have complained that URE does not promote itself as well, and in truth, it seems like there is a certain amount of truth to it; Paul van Eeden comes on RoBTV regularly to talk about Strateco and Strathmore has its own stable of publicists.

In any case, a look at the six month chart of URE shows two sharp rises followed by several months worth of consolidation and steady accumulation; Bollinger Bands in recent months have increasingly narrowed due to decreased volatility. The last few months have formed what might be interpreted as an ascending triangle, which if true, would be a bullish indicator. Volume has also picked up in recent days after contraction in recent months, culminating in today's 9% rise to $4.40 on three times the normal trading volume. We might indeed be witnessing the next sharp rise in URE, which hopefully, would knock out the old high of $4.70.

Thus, technically and fundamentally, I continue to like Ur-Energy.

0 Comments:

Post a Comment

<< Home