Uranium Stock Profile: ENERGY FUELS (CVE:EFR)

ENERGY FUELS (CVE:EFR)

Energy Fuels Inc. is a Toronto-based mineral exploration and development company with uranium and vanadium projects located in the States of Colorado, Utah and Arizona, through its wholly-owned Colorado subsidiary Energy Fuels Resources Corporation, and with gold, base metals and platinum group properties located in Newfoundland and Quebec and the Roberts property in Northern Ontario, which is prospective for uranium.

It is also a uranium junior that is on the cusp of production visibility, but needs to clear up several outstanding issues. The company was profiled by Lou Shizas a few weeks ago on RoBTV. Following is a summary of Schizas, with my own commentary mixed in:

Lou Schizas, equities analyst, Report on Business Television

On Properties

Yes they "may" begin production on some properties, mine in Colorado, they plan 2-3 hundred tons/day, existing mine site that they rehabiliting..they do have drilling permits in place in 2007 on that property so they want to extend that mineralization, prove more deposits..they also have other preexisting minesite, "could" begin in 2007, spend $2 million for rehabilitation..and the Tenderfoot plan, 100 tons/day, early-mid 2008

I think realistically, 2007 production is out of the question, although any uranium production by 2008 would force many people to reevaluate this company; still, I agree with the emphasis on "may" and "could" from Lou because there is still much work to be done.

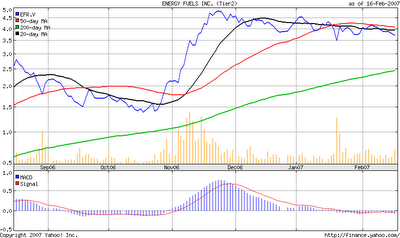

On Stock Chart

I see vertical = stick --> pennant, usually when you work this out, break to the upside..it is little bit long in the pennant formation but it is definitely something to look at overall..I think drill results and operating environment will be catch-all..if you can find some support at these particular levels, it has been a great wealth generator..now we have to see them perform..

The flag in a pennant formation does not last 3+ months, as has been the case for EFR, although the stock does look to be forming a symmetrical triangle and has hit its Fibronacci retracement. I would favor a continuation of the uptrend for EFR, but one of major current issues that the company has to deal with is to file its delayed financial statements; the gaffe was blamed on the increase in business activity of its wholly-owned U.S. subsidiary during the Company's fourth quarter for the financial year ended September 30, 2006. Investor uncertainty around this issue certainly seems to be one of the factors preventing Energy Fuels from taking another run up and expanding on its $170 million market cap.

Overall, an intruiging stock, certainly worth following up on..

Energy Fuels Inc. is a Toronto-based mineral exploration and development company with uranium and vanadium projects located in the States of Colorado, Utah and Arizona, through its wholly-owned Colorado subsidiary Energy Fuels Resources Corporation, and with gold, base metals and platinum group properties located in Newfoundland and Quebec and the Roberts property in Northern Ontario, which is prospective for uranium.

It is also a uranium junior that is on the cusp of production visibility, but needs to clear up several outstanding issues. The company was profiled by Lou Shizas a few weeks ago on RoBTV. Following is a summary of Schizas, with my own commentary mixed in:

Lou Schizas, equities analyst, Report on Business Television

On Properties

Yes they "may" begin production on some properties, mine in Colorado, they plan 2-3 hundred tons/day, existing mine site that they rehabiliting..they do have drilling permits in place in 2007 on that property so they want to extend that mineralization, prove more deposits..they also have other preexisting minesite, "could" begin in 2007, spend $2 million for rehabilitation..and the Tenderfoot plan, 100 tons/day, early-mid 2008

I think realistically, 2007 production is out of the question, although any uranium production by 2008 would force many people to reevaluate this company; still, I agree with the emphasis on "may" and "could" from Lou because there is still much work to be done.

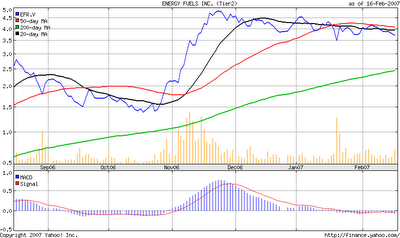

On Stock Chart

I see vertical = stick --> pennant, usually when you work this out, break to the upside..it is little bit long in the pennant formation but it is definitely something to look at overall..I think drill results and operating environment will be catch-all..if you can find some support at these particular levels, it has been a great wealth generator..now we have to see them perform..

The flag in a pennant formation does not last 3+ months, as has been the case for EFR, although the stock does look to be forming a symmetrical triangle and has hit its Fibronacci retracement. I would favor a continuation of the uptrend for EFR, but one of major current issues that the company has to deal with is to file its delayed financial statements; the gaffe was blamed on the increase in business activity of its wholly-owned U.S. subsidiary during the Company's fourth quarter for the financial year ended September 30, 2006. Investor uncertainty around this issue certainly seems to be one of the factors preventing Energy Fuels from taking another run up and expanding on its $170 million market cap.

Overall, an intruiging stock, certainly worth following up on..

1 Comments:

Another aspect that I like about EFR is their management, which is extremely experienced and knows how to accomplish the things needed to started production. Having said that, their inability to file financial statements, however, somewhat ironic..

Post a Comment

<< Home