Broad Market Correction: Safe to Buy Uranium Stocks Yet?

The rapidity of last week's events caught many investors off guard, with the precipitate being China's Shanghai Composite Index falling nearly 9%; the reason for decline, I might mention, was the government's fear of rampant market speculation, and not attributed to fears of China's economy slowing down. Indeed, one of the influential bulls of our investing world, CIBC's Jeffrey Rubin, noted that where China's economy has grown on average 9-10%/year, its stock market actually declined significantly in the years before this and last, so the correlation is certainly not strong between stock market trends and overall economic outlook in the East.

Rumors of a slowing Asian economy, US sub-prime collapse, or unwinding of the Japanese carry trade notwithstanding, markets found any and every excuse to correct downwards. However, it is important to stress, as I had before during the mini January correction, that uranium fundamentals have not changed. Whether it is commodities guru Patricia Mohr of Scotiabank (at least $90, headed to $100 end of 2007), CEOs Phillip Shirvington and Neil Froneman (>$100) of soon-to-be merging uranium mid-tiers Urasia Energy (UAEYF.PK) and sxr Uranium One (SXRFF.PK) or Australian Bureau of Agricultural and Resources Economics ABARE ($94.20 average this year, $103 average 2008), forecasts for yellowcake have only been revised upwards.

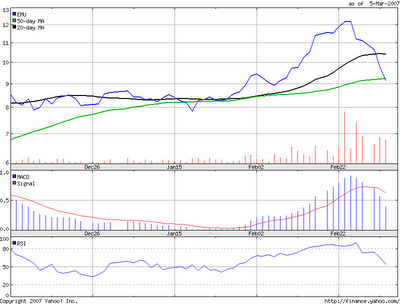

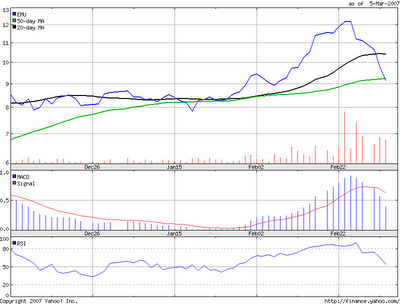

The extra haircut that uranium stocks experienced was NOT because of an annoucement from Cameco, theoretically, stating that its flooded Cigar Lake mine would be coming back online soon, but more likely was becuase uranium stocks were extremely overbought and desperately NEEDED the correction. Too many speculators, too much froth. A chart of Energy Metals below typifies the technicals of many many uranium stocks lately that scream for a much needed correction.

Judging by the double-digit rebound in uranium stocks today, coupled with my view that nothing in the broader macroeconomic world or in the uranium world convinces me something is fundamentally different now than a week ago, I venture to say that the worst is over. Not to say there will not be more correcting now and, certainly, sharp, short corrections will be present in the future, but the risk-reward balance seems to have shifted sufficiently for many uranium investors to have regained confidence already.

Rumors of a slowing Asian economy, US sub-prime collapse, or unwinding of the Japanese carry trade notwithstanding, markets found any and every excuse to correct downwards. However, it is important to stress, as I had before during the mini January correction, that uranium fundamentals have not changed. Whether it is commodities guru Patricia Mohr of Scotiabank (at least $90, headed to $100 end of 2007), CEOs Phillip Shirvington and Neil Froneman (>$100) of soon-to-be merging uranium mid-tiers Urasia Energy (UAEYF.PK) and sxr Uranium One (SXRFF.PK) or Australian Bureau of Agricultural and Resources Economics ABARE ($94.20 average this year, $103 average 2008), forecasts for yellowcake have only been revised upwards.

The extra haircut that uranium stocks experienced was NOT because of an annoucement from Cameco, theoretically, stating that its flooded Cigar Lake mine would be coming back online soon, but more likely was becuase uranium stocks were extremely overbought and desperately NEEDED the correction. Too many speculators, too much froth. A chart of Energy Metals below typifies the technicals of many many uranium stocks lately that scream for a much needed correction.

Judging by the double-digit rebound in uranium stocks today, coupled with my view that nothing in the broader macroeconomic world or in the uranium world convinces me something is fundamentally different now than a week ago, I venture to say that the worst is over. Not to say there will not be more correcting now and, certainly, sharp, short corrections will be present in the future, but the risk-reward balance seems to have shifted sufficiently for many uranium investors to have regained confidence already.

2 Comments:

What do you make of the latest announcement from ERA?

http://www.energyres.com.au/__data/assets/pdf_file/2563/20070307_Weather_impacts_ERA_operations.pdf

Energy Resources of Australia Ltd

ABN 71 008 550 865

7 March 2007

WEATHER IMPACTS ERA OPERATIONS

A tropical low pressure system which led to the formation of cyclone George resulted in

nearly 850 millimetres of rain falling over Energy Resources of Australia Ltd’s Ranger

operation in the seven days to 4 March. In one 72-hour period alone, a total of 750

millimetres fell. The area has received 1,600 millimetres to date this year, which is above the

total annual average rainfall.

ERA has declared force majeure on its sales contracts as a result of the effect of the rainfall

on production at the Ranger mine and processing plant.

As advised to ASX on 1 March, mining operations ceased on 27 February as is normal

practice during high rainfall and the plant was shut down in a planned manner on 28

February.

The mine has restarted operations today and the processing plant is expected to restart

within the next week.

First quarter production is estimated to be between 20 and 30 per cent lower than in the

corresponding period last year. The impact of the water level in the operating pit is still being

assessed, however production will be impacted in the second half of 2007.

In spite of the high rainfall, water inventories at the mine site have been managed effectively

and there has been no adverse environmental impact.

Access to and from the Ranger mine and the nearby township of Jabiru remains restricted by

highway closures and load limitations due to the widespread flooding in the region.

nice post, I was not aware of this story coming out of ERA..since we invest with the confidence of uranium fundamentals behind us, it is important to watch out for anything that may affect supply-demand..I'd like to refer you to another piece of news coming out of Australia from ABARE, which roughly coincides with my views on uranium, that supply-demand will eventually balance out in ~2 years. it certainly puts an investing framework in my mind

http://www.news.com.au/heraldsun/story/0,21985,21337407-664,00.html

Post a Comment

<< Home