9th Uranium Stocks Pick: Energy Fuels (TSE:EFR)

KEY PROPERTIES

Whirlwind

Energy Fuels acquired the Whirlwind properties located in Utah and Colorado several months ago. The key in the acquisition is its uranium and vanadium Whirlwind mine. A January 2007 NI 43-101 compliant technical report of the mine disclosed current Indicated resource of 657,000 lbs of uranium oxide and 2.17 million lbs of vanadium oxide based on 69 drill holes while recommending further drilling to be done; the company has contracted another 19,500 feet of drilling to be finished in 2007 on its Whirlwind claims in hopes of finding additional deposits.

In order to put the Whirlwind mine into production and graduate from production visibility to the select group of producers, the company needs to meet certain goals, including steps to rehabilitate the mine (expected to start Q2 2007 lasting 6 months with expected CapEx <$1 million), negotiating a tolling arrangement, preparing a pre-feasibility study, and obtaining full approval of the expansion of its existing permit. If everything goes as planned, Energy Fuels plans to reopen the Whirlwind Mine by late 2007, with processing scheduled a year later once stockpiles have been gathered to adequate levels.

Energy Queen

Located in Utah, Energy Fuels is planning to bring this existing mine into production with a $2 million US mine rehabilitation program that, although the company has a mining permit in place, will require a dewatering permit. Stockpiling of material is optimistically projected to be in mid-2007.

Tenderfoot Mesa

These claims include two past-producing uranium mines called Sapphire and Torbyn located in the Uravan Mineral Belt; the latter mine was reopened in Q4 2006 with some minor rehabilitation. Again, material could be stockpiled as early as mid-2007, with the company expected to drill another 21,500 this year to further delineate these claims.

Personnel

Energy Fuels is run by very experienced people, most of whom were part of its predecessor company, Energy Fuels Nuclear Inc.. Indeed, the current President and CEO of uranium behemoth Cameco Corporation, Gerald Grandey, held the same positions at Energy Fuels Nuclear and its former VP Marketing and Corporate Counsel, George Glasier is Energy Fuels’ current president and CEO; the former VP Exploration, Chief Geologist, Mill Manager, Mine Superintendent and General Mine Superintendent of the predecessor company—which was the largest uranium producer in the United States in the 1980s—have since returned to upgraded roles in this new incarnation.

Stock and Future Developments

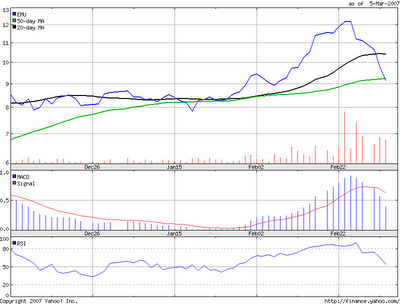

After more than tripling in just a month from the middle of October to November 2006, Energy Fuels’ stock has spent the next four months consolidating its gains and making a solid base to prepare for another run. The company had been hampered by tardiness in filing its most recent financial statements, which it has since remedied. Furthermore, its stock will likely be buoyed by approval to start trading on the bigger Toronto Stock Exchange on March 19th, with a spade of announcements expected in 2007 in regards to drilling results, permitting, and updates on mine re-openings.

With $28 million in the bank (as of Jan 7, 2007) and no debt outstanding, Energy Fuels seems poised to capitalize both as a uranium junior with production visibility and as a potential takeover candidate for one of the emerging uranium seniors, given its mines are within striking distance of Denison’s White Mesa Mill and also sxr Uranium One’s Shootaring Mill—although the company might in the end decide to build their own. Certainly, with the vast amount of work still needed to be done, Energy Fuels has perhaps an overly ambitious timeline to production, but still represents a solid uranium stock that has real assets to work with and should be in production when uranium prices are expected to peak in 2008-2009.