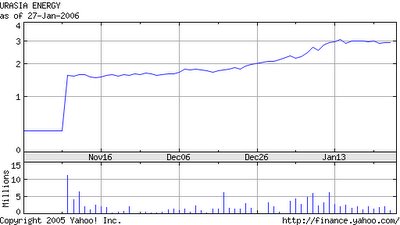

1st Uranium Stocks Pick: Urasia Energy (CVE:UUU)

The Urasia Story (PART I)

UPDATE: PLEASE READ ALL THE URASIA ADDENDUMS BEFORE BUYING THIS STOCK!

First, A Little Necessary Reading

PRESENT

from their own website:

UrAsia Energy Ltd. ("UrAsia") began trading on the TSX Venture Exchange (TSXV) on Tuesday November 8 under the trading symbol UUU. UrAsia is one of the four listed uranium producers in the world, and one of three now listed in Canada. UrAsia's annualized production is an estimated 1.4 million pounds of uranium, which comes from its 70% interest in the Akdala in-situ leach uranium mine in Kazakhstan. The company's goal is to be producing in excess of 10 million pounds annually by 2015 from at least three assets in Central Asia.

A FEW MONTHS AGO

from the Managment Discussion and Analysis (Dec 15, 2005):

In September 2005, the Company signed a binding letter of agreement with UrAsia BVI pursuant to which the Company agreed to acquire all of the issued and outstanding shares of UrAsia BVI in consideration for the issuance of post-consolidation common shares of the Company.

In November 2005, the Company completed the Acquisition in consideration for the issuance of 413,581,250 post-consolidation shares of the Company to the shareholders of UrAsia.

As part of the Acquisition, UrAsia acquired a 30% interest in a Kharassan uranium project located in south central Kazakhstan through the purchase of a 30% interest in the Kyzylkum JV in consideration for approximately $89 million (US$75 million) of which approximately $44.5 million (US$37.5 million) was paid in cash and $44.5 million (US$37.5 million) was paid by the issuance of 24,181,500 ordinary shares of UrAsia.

As part of the Acquisition, UrAsia also acquired a 70% interest in the Betpak Dala Joint Venture (“Betpak JV”) in consideration for approximately $415 million (US$350 million). The Betpak JV has a 100% interest in the Akdala ISL uranium mine and a 100% interest in the South Inkai ISL uranium development project, both located in south central Kazakhstan.

Analysis of the Betpak JV Acquisition

Through raising about $500 million dollars (biggest ever for a Venture exchange stock), Urasia managed to vault themselves ahead of all the uranium junior exploration companies in a single stroke. Their 70% interest in the Betpak Dala Joint (the other 30% belongs to KazAtomProm [remember them?]) lets Urasia have immediate access to 1.4 million pounds of uranium oxide a year.

Thus, I'm not talking about a company just laying claim to as much land in the Athabasca Basin as humanly possible. God knows there are enough of them out there. This is immediate production that can take advantage of the upward prices of uranium. No waiting for seismic tests, no permits that take years to process. I cannot stress this enough. They are getting uranium out of the ground right now!

The Akdala ISL mine is estimated to have 18.77 million pounds of uranium. The people who checked the older Kazatomprom resource estimate and converted them to the new estimate uses the NI 43-101 gold standrad of reporting. Again, this is nothing like other companies who claim reserves based on "historical reports."

So, to recap the Akdala mine, they is 18.77 million pounds of uranium using the inexpensive ISL (in-situ leeching) technique @ a rate of 1.4 million lb/year with the potential of "establishing additional measured and indicated resources of 12 million to 13 million tonnes at a grade of 0.04% to 0.06% containing 5,000 to 8,000 t U (thats 10-16 million pounds if they are using short tons) by infill drilling of the inferred resources and extensions of the roll fronts within the current licences."

How about the Inkai project? After all, they did shell out $350 million US not only for Akdala, but for the potential in Inkai. Again, following NI 43-101 guidelines, they have an estimate of 14,068 tons (28 million pounds), with a potential for 32,000 to 40,000 more. This however, is only an estimation and it must be emphasized that Inkai is undeveloped as of right now.

Okay, so when Urasia made this acquisition in September 2005, the price of uranium was ~$30/lb US. Ah, but wait. That was in September 2005. Today is almost February and uranium is closer to $37/lb US. They had expected total Akdala revenue over the course of its mine life to be $30/lb * 18.77 million pounds = ~$560 million US. Now it is more like $700 million.

This is uber simplistic of course. I didn't factor in production costs and all the rest, but I also did not count the further expandability of the Akdala mine or their undeveloped assets in Inkai.

Fair's fair, but this is just to illustrate that Urasia bought Betjak BV (containing Akdala and Inkai) at the right time. By being quick and pulling the trigger on the deal they managed to snag assets that are growing in value by virtue of the rising uranium price.

What's the kicker here? To my knowledge, Urasia is not locked into a long-term uranium contract. How important is this? Well, think about it. Cameco has been around for years and years. So when uranium was traded @ < $10/lb, they would obviously hedge and sell uranium to the same buyer at a fixed price to ensure they won't be screwed over by the less than appetizing price. Cameco is still more or less hedged this way. If you look on the graph, the price of uranium has only recently begun to ascend steeply. What does this mean? Urasia is in the position to capitalize. Timing is everything, and I believe this company has timed things perfectly to be in the best position possible.

A Thought:

Do you know who is lurking in the background of Urasia as the non-executive chairman? Ian Telfer. Yes, the same guy who is CEO of the $9 billion US marketcap Goldcorp. If you believe in the right people, there you have it. I for one, am not about to bet against Urasia.

UPDATES

6 Comments:

Diamond:

I ma back again. It is nice to see you make UrAsia as your first pick of the uranium stock. Great work. I also bought my UUU last week, guess what, same price as yours, 3.00 dollars. For the past week, UUU has been traing with alot of volume and always hanging around 2.90 area( Low 2.85 if i remember correctly). I think i will be buying more next week once i sell my under performed TBL.UN.

welcome back benben. I may have bought UUU at a slightly higher entry price than I wanted to and it's been straddling that 3 buck barrier for over two weeks now, but i'm really not that worried because i'm a long-term investor. my technical analysis is not really that strong, but if you invest long-term, i don't think it matters as much because you just pick great companies, buy their stock, and forget about them.

Daimond:

So, based from what u are saying. UUU should be a a long term investment? When and what price do you think UUU will start to move up? and what price do you expect to get to?

hey again benben. you know what? i haven't really given much thought to a specific price target. alot of it has to do with the price of u308. it's really hard to project urasia's value right now. case in point, urasia has a market cap of $1.2 billion right now while cameco's is $18 billion. is urasia worth 1/15 of cameco? is cameco overvalued? it's hard to say..but i'll address this issue in my next update

AM SOMEWHAT CAUTIOUS OF LONG TERM INVESTING HALF A WORLD AWAY - ESP WITH ALL THE SABRE RATTLING AND BROKEN PROMISES AND ENERGY SUPPLY ISSUES. FOLKS HAV GONE TO WAR FO' LESS

$2.60 eh? that's a might fine price. if i had more money i'd try to average out my shares too. unfortunately i do not =P

Post a Comment

<< Home