Casey's Energy Speculator

The Casey Files:

For more than twenty years, Australia-with its rich uranium resources-has been largely closed for yellowcake mining. But now the country may be preparing to open its doors to junior uranium explorers and producers, which, in view of the Cigar Lake breakdown, would be a major step to ramping up production in the foreseeable future-and could provide some excellent investment opportunities. Below, senior researcher Chris Gilpin breaks down some key developments expected Down Under during the coming months..

Doug Casey, Casey Energy Speculator

April 29 - a Day to Watch for Uranium Investors

Australia is poised for a breakout in uranium production. The land down under hosts 36% of the world's reasonably assured uranium resources (recoverable at low cost)--more than any other country--and yet it accounts for only 23% of global output. But that picture could change drastically in the next few years.

The current opposition party in Canberra--the federal wing of the Australian Labour Party--could have the largest influence on the future of the uranium industry. Their leader, Kevin Rudd, supports a rethinking of Labour's opposition to uranium mining. The federal Labour conference takes place on April 27-29 and will be a pivotal event for Australian uranium politics.

Why? A federal election must occur in Australia sometime in the second half of 2007. Kevin Rudd is a popular figure, and polls show that Labour has pulled ahead of John Howard's ruling coalition for the first time in years. The last Morgan poll gives Labour 48% of the popular vote, while John Howard's coalition sits at 38%.

Labour holds the balance of power in each and every one of Australia's states and territories. Its regional governments' attitudes toward yellowcake vary. New South Wales and Victoria ban all uranium-related industrial activity, even exploration. Queensland and Western Australia straddle the fence, allowing uranium exploration but not uranium mining. Tasmania has no ban in place, but has never drawn interest from uranium explorers. Only South Australia and the Northern Territory (neighbors in the middle of the continent) have allowed uranium mining.

Here's why the April Labour conference could be a game-changer: Queensland's premier, Peter Beattie, says that his state will fall in line with the policy that reaches consensus at April's gathering, which could signal an immediate boon to companies working in that province.

The stakes are enormous. Because of past governmental disincentives, few of Australia's prospective uranium regions have been explored with up-to-date technology. There's big potential for a significant discovery in the Northern Territory, where, according to a November 2006 report by the Northern Territory Minerals Council, only 20% to 25% of the prospective rock units have been effectively explored.

Most likely this holds true for other regions of Australia as well. Today airborne electromagnetic surveys can yield useful data from ten times deeper into formations than they could in the 1970s. Many authorities, including the Uranium Information Centre and Geoscience Australia, believe that past exploration was superficial by today's standards and that there are several resources at depth waiting to be found.

A look at history makes it even more apparent how groundbreaking Labour's potential change of attitude could be. In 1984, the federal Labour government instituted the "three mines policy," which was intended to eventually end all uranium mining in Australia. The law stipulated that only the three uranium mines in production at the time would be given permits to export uranium: the Olympic Dam project (the world's largest uranium mine) in the state of South Australia, and the Ranger and Nabarlek mines in the Northern Territory. Provisional approvals for other would-be uranium mines were cancelled. Labour's notion was that when the three producing deposits had been exhausted, uranium mining in Australia would be finished for good. Exploration cratered, and today Australia’s known resources are little changed from what they were 20 years ago.

After John Howard's coalition government swept into power in 1996, it scrapped the three mines policy. But because state and territorial governments were all dominated by the Labour party, the industry still made little progress. In fact, the Nabarlek mine had already shut down in 1988, leaving only two mines in operation. In 2000, the Beverley mine in South Australia opened, bringing the number back up to three. And today there is the prospect that SXR Uranium One's Honeymoon project will become Australia's fourth uranium mine. SXR Uranium One received its export permit from the federal government in January of this year, an essential step for uranium production in a country that hosts no nuclear facilities.

With Labour threatening to win the 2007 federal election, that party's stance on uranium will be pivotal for Australian exploration companies and, indeed, for the global uranium market as a whole. This April's conference will provide crucial clues as to the shape of things ahead.

http://www.caseyresearch.com/learnMore.php?pubId=2&ppref=USI002BN0207A

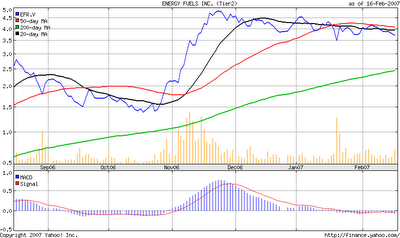

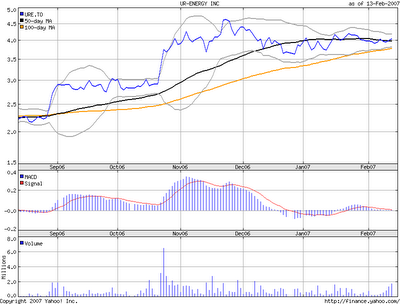

A broad market correction beginning May 2006 in both American and Canadian exchanges stalled momentum as speculative money went out of uranium; notice the flattish slope from May until the beginning of October in my subscription rate as people were less enthused after the market correction

A broad market correction beginning May 2006 in both American and Canadian exchanges stalled momentum as speculative money went out of uranium; notice the flattish slope from May until the beginning of October in my subscription rate as people were less enthused after the market correction